The round-table conference 'CHINA AND THE WORLD: CHANGING REALITY AND SHARED FUTURE' was held online sucessufully on 31st July 2020, which was co-organized by the Institute for a Community with Shared Future (ICSF) from China, the Centre For New Inclusive Asia (CNIA) from Malaysia, and The Dialogue of Civilizations Research Institute (DOC Research Institute) from Germany. Experts and reserchers from China, Germany, Malaysia, the UK, the US, Singapore, South Africa and etc. shared their perceptions and ideas with rational arguments from multi-perspectives towards the transforming world situation under both the COVID-19 pandemic and the tension of China-US relation, and then discussed solutions to expect a promising shared future for the whole humankind. The article below was compiled from some expert's speech on the conference. --Eds

The World Economy and World Trade after COVID-19

Professor Bert Hofman

Director of East Asian Institute, National University of Singapore

It's great pleasure to be able to contribute to this conference. I'm gonna really talk about the economics as one of the key factors of today's world.

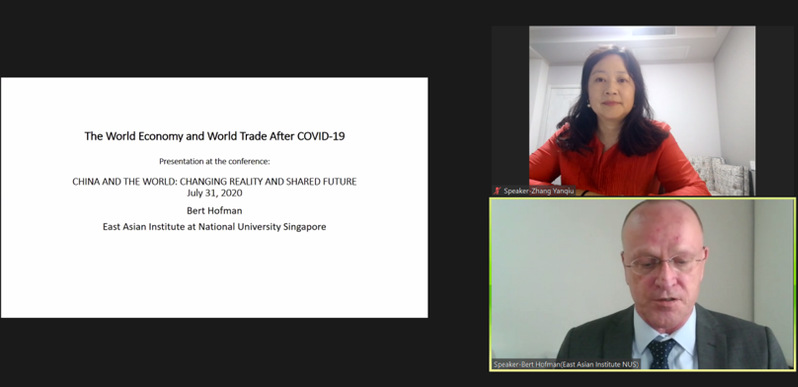

The big economic impact of COVID-19, and how big it is illustrated in this chart in Pic 1, as in per capita income is much larger than the global financial crisis. It's not as large as the world decline in income during the great depression, but very deep recession after the second world war. But according to the World Bank, the per capita income when everything is set and done after COVID, will decline by 5.2%.

Pic 1

The IMF has projected for this year decline in GDP and world production is going to be around 5%. Before covered in general, they were still predicting a growth of plus 3%. So there's a total decline as a consequence of COVID of minus 8% of GDP truly unprecedented decline. At least we haven't seen that since world war II, advanced economies decline of 8%. A Euro Zone declines with 10% of GDP. South Africa, declines with 8% of in the GDP growth. The only one standing is China. And the IMF projects 1%. But frankly, Asian going to be 2%- 3% growth this year.

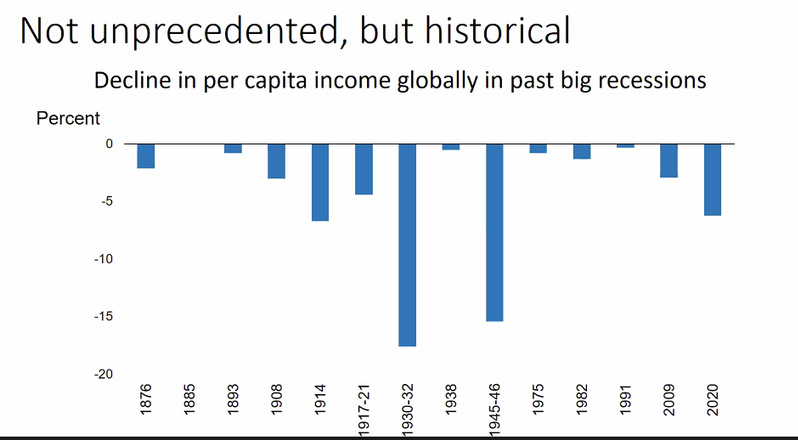

Pic 2

The only major economy in the world that will be growing is going to be China. but a consequence of decline in growth, you see a huge decline in world trade. And we're only halfway through. But in April 2020, those the latest global numbers that we see a decline of 16% in world trade that is almost as high as the 19% at this all during the global financial crisis. But it's not over yet as an effect. May and June will probably be worse than this. So a huge effect of COVID-19 on the world trade, probably even though we don't know yet. Probably the impact on a particular part of world trade, the global value change will be as large.

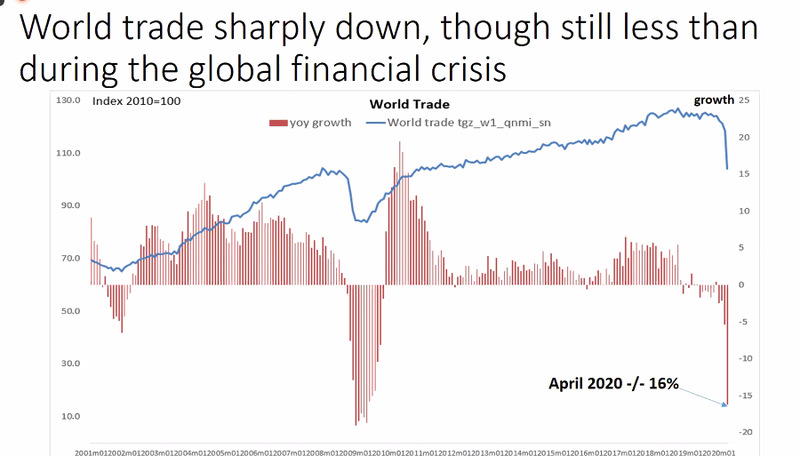

Pic 3

If you look at the global financial crisis in 2009, you saw a big impact on this part of global value change, IE, goods that are produced in multiple countries that decline much more during a crisis than no more goods trade will probably see similarly in as a consequence of the COVID-19 crisis. In those global value chains, there's been a huge shift towards China in 1995. China wanted a small back office of Japan and Korea, and they were the main exporters to the United States. And Germany was central to the European value chains. Switch to 2016, you see that China has taken a very central role in the trade flow system. Arrows depict the trade flows in the world. And is the major trader in the world, the biggest supply to the United States, together still with the Germany as major on the European supply chains. And Japan has begun the back office, Korea has begun the back office of China. So a dramatic turnaround between the 20 years up to 2016. In part because China and the WTO, in part because a lot of the existing value chains that were already in Asia move to China as a base for final assembly. But there's more to it than that.

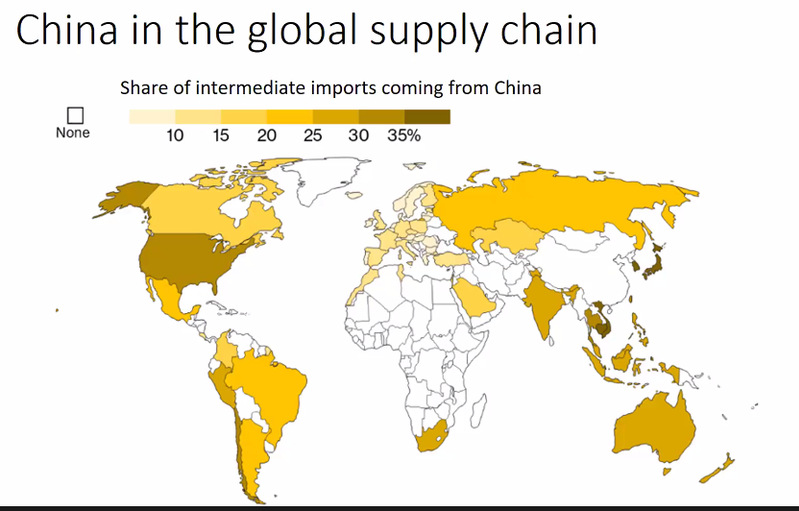

Pic 4

More recently, China's role has started to shift. China share of intermediate imports from China has become quite large. And especially in Southeast Asia, but also in Japan and Korea. China has become a major supplier of intermediaries for final production in China. That is almost like turning the tables on world trade compared to 10 or 20 years ago when a lot of intermediaries were exported from Korea and Japan to China. So a very different role of China, much more central role of China in global value chains, a much more central role of China in growth. But even though China's share of exports to GDP has become less important for China itself. Now this covert going on.

Pic 5

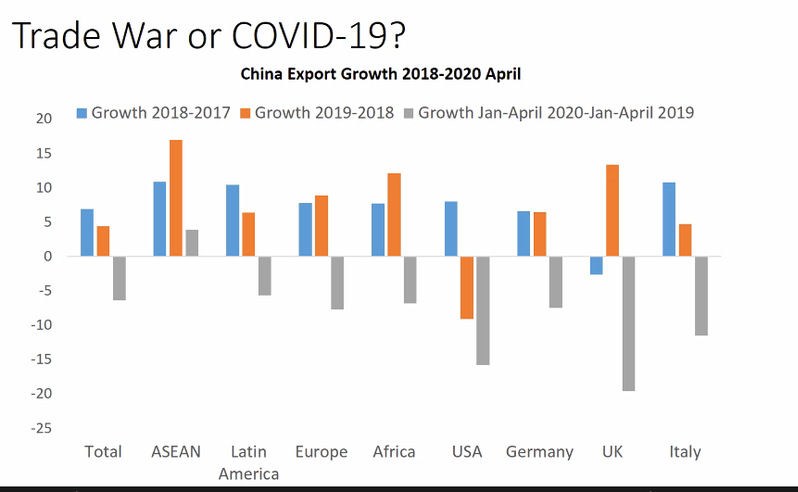

But there's something else going on in trade as well. And that is the trade war between the United States and China. And to disentangle what is the effect of COVID then, what is the effect of the trade war? I looked a little bit back on. These are the growth in trade in China's exports into various parts of the world at 2017, 2018, 2019, and generate a generator January-April 2020 over January-April 2019. So if you want, the orange bar really shows the effect of the trade war, which was already going on last year. So what you see is a major decline of China's export to the United States. But every other part of the world is still positive. Most positive is ASEAN: Southeast Asia. China is shifting. Lots of its exports to ASEAN has become a much closer tied to ASEAN. As a matter of fact, not just trade, but also investment from China is going more and more to ASEAN.

The gray bar is the COVID effect. That's, of course, affects trade to almost everybody, more to the United States, even more to the UK which was very hard hit by COVID-19. But again, the positive one is ASEAN. Indian seem to benefit the trade between China and ASEAN on those ties are getting stronger, whereas a lot of other ties are getting weak up.

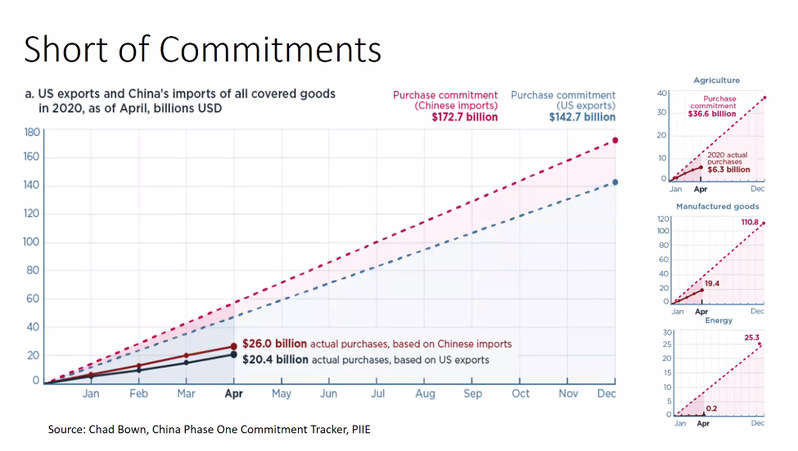

Pic 6

The trade war is not out of the woods. There was just before COVID-19. There was an agreement between the United States and China, where China committed to import about 200 billion from the United States. China as well both in an agriculture goods are manufactured goods and energy. There might be in October. Surprise, one of the disruptions that might come before the Elections is that the United States with China is not meeting its commitment. And the deal is off. It would be for the disruptive, it would be further strengthened.

Those trends that I showed, less exports of China to the United States, and more disruption in world trade. If that happens, the trade war that's already going on. There is a technology war starting to build. There might be a financial war growing. There is lots of talk about access of Chinese companies to the United States market. There is talk about measures that the United States can take to exclude Chinese banks from the dollar based international payment system. Hugely disruptive steps, irrespective of what will happen in the future. If there is to be a cold war, at least the cold war, and in economic relationships, will be very different from your fathers or depending on your age, on your grandfather.

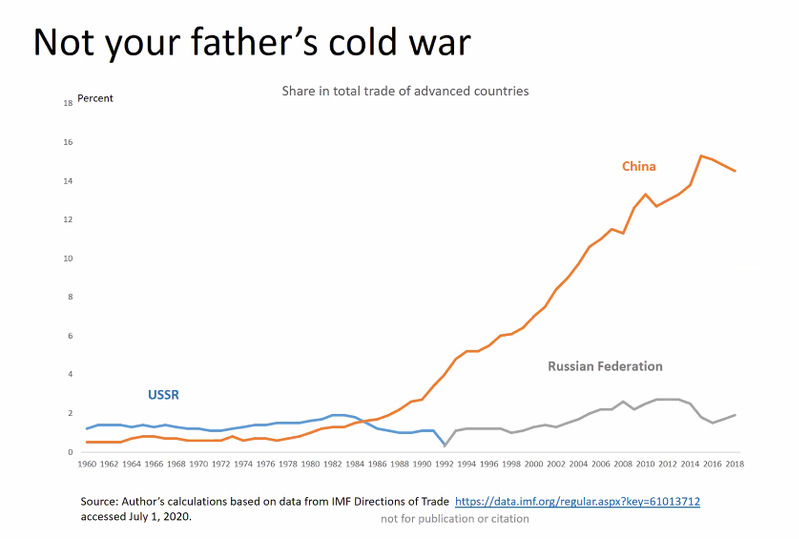

Pic 7

This is the trade, the share of total trade to advanced countries of the USSR, the old soviet union, back in the sixties. And that was never more than 2%. And has, in fact, even the Russian federation has never trade much with the western bloc. A sharp contrast with China, which supplies almost 16% of total trade, so a larger shed on China's wage in the world economy, it actually trades with advanced countries. If this were to unwind, if this were to be decoupled in the future, that would be hugely disruptive. It would be very damaging to China, but also to the advanced countries.

So as an economist that I am an economist, I would say there's a huge value, in maintaining the relationships in maintaining a good amount of integration. There are some issues on China that needs to move. But the United States and Europe also have a very large domestic agenda that would help them become stronger. That would help them become more confident if you want economically, to continue to work together with China. Thank you very much.

See Chinese Translation, view http://icsf.cuc.edu.cn/2020/1006/c5607a173647/page.htm

Speaker: Professor Bert Hofman

Record: Li Zhe